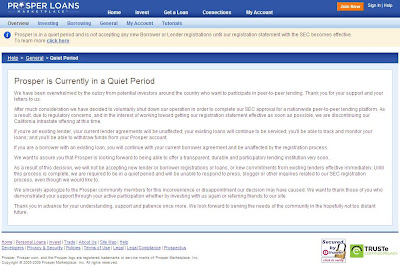

Prosper is Currently in a Quiet Period

We have been overwhelmed by the outcry from potential investors around the country who want to participate in peer-to-peer lending. Thank you for your support and your letters to us.

After much consideration we have decided to voluntarily shut down our operation in order to complete our SEC approval for a nationwide peer-to-peer lending platform. As a result, due to regulatory concerns, and in the interest of working toward getting our registration statement effective as soon as possible, we are discontinuing our California intrastate offering at this time.

If you're an existing lender, your current lender agreements will be unaffected; your existing loans will continue to be serviced; you'll be able to track and monitor your loans; and you'll be able to withdraw funds from your Prosper account.

If you are a borrower with an existing loan, you will continue with your current borrower agreement and be unaffected by the registration process.

We want to assure you that Prosper is looking forward to being able to offer a transparent, durable and participatory lending institution very soon.

As a result of this decision, we will not be accepting new lender or borrower registrations or loans, or new commitments from existing lenders effective immediately. Until this process is complete, we are required to be in a quiet period and will be unable to respond to press, blogger or other inquiries related to our SEC registration process, even though we would like to.

We sincerely apologize to the Prosper community members for this inconvenience or disappointment our decision may have caused. We want to thank those of you who demonstrated your support through your active participation whether by investing with us again or referring friends to our site.

Thank you in advance for your understanding, support and patience once more. We look forward to serving the needs of the community in the hopefully not too distant future.

While Prosper is closed, Lending Club has the full blessing of the SEC and has facilitated nearly $40 million in loans.